There is strong growth in the global financial advisory business market. It is estimated to be worth as much as $103 billion in 2024 and is expected to grow to $174 billion within the decade, a compound annual growth rate (CAGR) of 6.02. At the same time, unprecedented growth is occurring in the sector of cross-border payments. By 2024, the market size is estimated to be $212.55 billion, or even higher by 2030 at 320.73 billion. This boom is a big opportunity for the financial advisory firms to provide an international financial advisory business model.

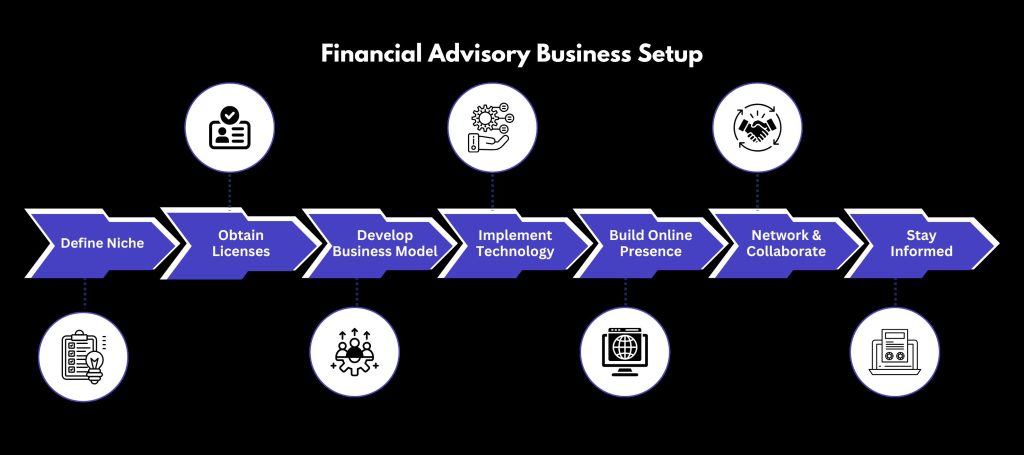

How To Start Your Own Financial Advisory Business

1. Identify Your Niche and Services

Determine your target market: high-net-worth individuals, expatriates, or small- to medium-sized businesses (SMEs). Offer your services according to their unique requirements, like wealth management, retirement planning, tax optimization, or estate planning. One of the ways to distinguish your firm in the competitive environment is to provide specialized services.

2. The Required Licenses and Certifications.

Ensure that you do not break local laws by getting the required licenses. Financial advisors are required to be registered with the Securities and Exchange Board of India (SEBI) in India. Certifications, like the Certified Financial Planner (CFP) or the Chartered Financial Analyst (CFA), may be credible abroad.

3. Build a Sound Business Model

Choose a model of business that suits your target market and services. It may be pay-as-you-drive, or commission-based, or both. The fee-only model is increasingly becoming popular due to its transparency and harmony of interests between the advisors and their clients.

4. Adopt Technology Solutions

Use financial planning software, customer relationship management (CRM) software, and a secure communication medium to simplify operations. The use of artificial intelligence (AI) will be able to offer individualization and can increase the interaction with clients.

5. Build an Online Presence

Develop a business web page and publish insights, articles, and case studies on social networks. Clients will be attracted to read interesting content and be assured that you know what you are talking about.

6. Network and Collaborate

Participate in industry conferences, webinars, and local business events to expand your network. Through joint ventures with accountants, lawyers, and other professionals, they can make mutual referrals and do business building.

7. Stay Informed and Adapt

Financial advisors have a dynamic scene. Monitor alterations in regulations, market trends, and other technological advancements to provide relevant and useful guidance to your customers.

Financial Advantages

- Recurring Revenue: Recurring revenue is generated through fee-based revenue models, including assets under management (AUM) or subscription.

- Scalability—Firms can serve additional clients without an equal proportional increase in overhead with technology and automation.

- Global Accessibility—International money transfers enable operation of business in foreign markets with higher revenue potential.

- Economic Resilience—Financial advisory services will not be affected in the face of market fluctuations because customers need advice services.

- High Profit Margin—Low physical infrastructure needs and advisory-type operations deal with keeping the cost at a manageable level.

Trends in the Financial Advisory Services Market.

- ESG Investments Integration—Sustainable and socially responsible investing are becoming dominant in advisory recommendations around the world.

- Regulatory Evolution—Firms need to keep abreast of global regulations, including data and financial compliance standards around cross-border.

- Digital Transformation – AI-powered tools and financial planning software allow individualised, effective advisory services.

- Client-Centric Advisory– Clients are becoming much more demanding in terms of transparency, ethical conduct and customised investment plans.

- Emergence of Remote and Cross-Border Advisory – Virtual advisory services give companies access to serve customers all over the world and increase their reach and operational capabilities.

Conclusion

Financial advisory business model is a good venture that entrepreneurs can take. With a proper niche definition, required certification, technology exploitation and keeping up with market trends, you will be able to create a successful and sustainable financial advisory business. Taking advantage of cross-border financial services can also increase the growth and expansion of your firm.